Vat In UAE

The United Arab Emirates (UAE) is one of the most advanced countries in the Middle East. It has a high-income economy, a stable political system, and a vibrant culture. The country has also achieved remarkable success in the areas of finance and technology. One of the most notable achievements of the UAE is the implementation of Value Added Tax (VAT), which is a consumption tax applied to goods and services.

VAT was introduced in the UAE on 1 January 2018, and since then, the country’s economy has seen a significant boost. The introduction of VAT was a big step forward for the UAE and was designed to help the country become more competitive in the international market. It’s expected to bring in more than AED 12 billion in revenue for the government.

VAT is a consumption tax system that is based on the principle of taxation of final consumption. This means that the tax is applied to the sale of goods and services at each stage of the supply chain. The tax is usually charged at a flat rate of 5% on most goods and services, although there are some exemptions. There are also certain types of services where the rate of VAT is zero.

The introduction of VAT in the UAE is expected to have a positive impact on the economy. It will help to boost the country’s economic growth and create more job opportunities. The government believes that the introduction of VAT will help to reduce the cost of living by making goods and services more affordable. It will also help to reduce the amount of money that is lost through tax evasion.

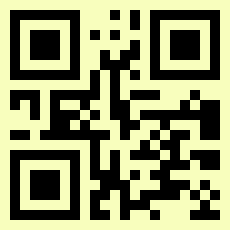

The UAE government has implemented a number of measures to ensure that the tax system is fair and transparent. For example, businesses need to register for VAT and obtain a VAT registration number. The government has also created an online portal where businesses can access information about the tax system and make tax payments.

VAT has been implemented in many other countries around the world, including the United Kingdom, Europe, and Canada. The UAE is one of the first countries in the Middle East to implement the tax system. It’s expected to have a positive impact on the country’s economy and help to attract more foreign investment.

The introduction of VAT in the UAE has been welcomed by the business community. Businesses now have more clarity about the tax system and are able to plan their finances better. They are also able to pass on the cost of VAT to their customers, which helps to make their products more competitive in the market.

VAT is a complex system, and there are still some areas where businesses are finding it difficult to understand. The government has set up a dedicated team of experts to provide advice and guidance to businesses to help them comply with the tax system.

The UAE is a leading economy in the region and VAT is helping to make it even stronger. The introduction of VAT has been a major success for the country and it is expected to have a positive impact on the economy. It’s expected to boost economic growth, create more job opportunities, and attract more foreign investment.

Summary

One of the most notable achievements of the UAE is the implementation of Value Added Tax (VAT), which is a consumption tax applied to goods and services. VAT was introduced in the UAE on 1 January 2018, and since then, the country’s economy has seen a significant boost. The government has also created an online portal where businesses can access information about the tax system and make tax payments. VAT has been implemented in many other countries around the world, including the United Kingdom, Europe, and Canada.

#expect #occupation #presentation #uae #service #businesses #ask #introduction #arrangement #avail #commercial_enterprise #politics #economy #expected #tub #good #tax #help #vat #government #assistant #system #commodity #services #goods #aid #business